Sale!

Description

Description :

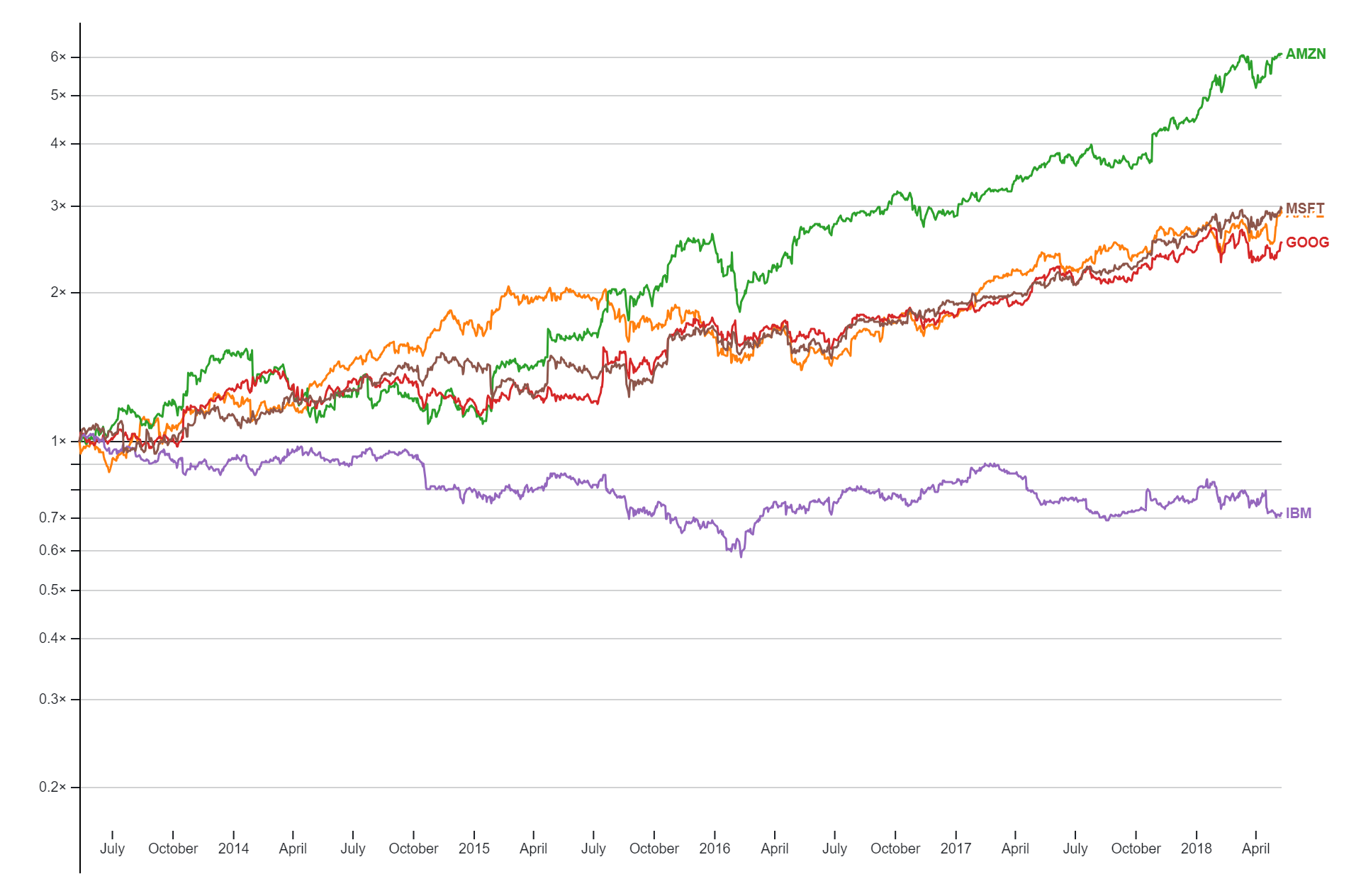

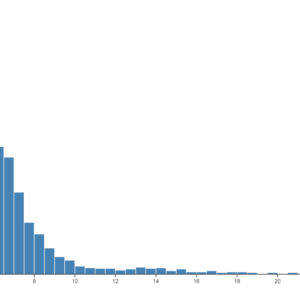

An index chart is a graphical representation that displays the performance of a specific financial market index over time. It typically consists of a line or bar graph showing the index value plotted against time, such as days, weeks, months, or years. Index charts are commonly used in finance and investment to track the overall movement and trends of a particular market index, providing insights into the performance of the underlying assets or securities comprising the index.

Purpose :

Uses :

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.