Sale!

Description

Description :

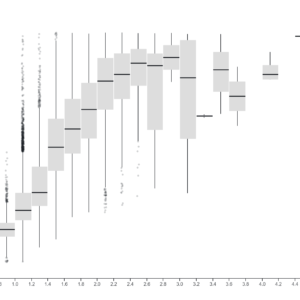

A candlestick chart is a type of financial chart used to represent the price movements of a financial instrument, such as stocks or currencies, over a specific period. Each candlestick on the chart shows the opening, closing, high, and low prices for that period. The body of the candlestick represents the price range between the opening and closing prices, while the wicks (lines extending from the top and bottom) indicate the highest and lowest prices reached during the period. Candlestick charts are widely used by traders and analysts to analyze price trends, identify patterns, and make informed trading decisions.

Purposes :

Uses :

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.